Bad Debt Relief 101 Claiming AR Bad Debt Relief Go to GST Manage AR Bad Debt 1. Repayment of the tax should be accounted for at a standard rate of 6.

Gst 15 Bad Debt What Is 6 Months Bad Debt Relief Pdf Free Download

Final gst return in relation to bad debt relief and the amount owing to.

. Item 2Accounting for GST on imported services. Bad debt relief other input tax. In normal situation you should claim bad debt relief on.

I have obtained a relief of bad debt before 01 June 2018. With the GST compliant versions of MYOB Accounting v20 and Premier v15 these tax codes have already been setup for you. A GST registered business can claim bad debt relief GST Tax amount paid earlier to Kastam if they have not received any payment or part of the payment from their debtor after 6 th months from the date of invoice.

Based on the GST Listing Draft post the GST Bad Debt Recovered double entry using Journal Entry. A registered person is entitled to a relief for bad debt if. What is the GST rate applicable on my repayment of the tax due and payable after 01 June 2018.

GST-Bad Debt Relief - Accounting Entry When you are Selling goods to customer with a Tax Invoice the double entry will be- Dr Debtor 212000 Cr Sales 200000 Cr Output Tax 12000 If you have not. The bad debt relief processed and saved will be listed on the grid section for user view and track User can double click on the record line to view the list of outstanding invoices selected for the. Double entry adjustment for the balance of GST Sales Purchase Deferred Tax Bad Debt Relief AFTER 29 December 2018.

Use the Bad Debt expense account with an GST code and enter 10000 into the Net amount field. Output tax adjustment for recovery of bad debt. GST on import of goods.

Look for Customer Aging Report Detail to identify which customer owed us more than 5 months month of six stated in GST Act. - a he has paid the tax in respect of a taxable supply. Athe person has not received any payment or part of the payment in respect of the taxable supply from the.

GST Malaysia Bad Debt Recovered Relief. The bank will provide a GST invoice to you and you can claim. Notification on Claim Bad Debt Relief In accordance with Section 58 of the Goods and Services Tax Act 2014 with effect from 2062016 if the bad debt relief is not claimed by the supplier in the immediate taxable period immediately after the expiry of the sixth month the notification to the Director General to defer such claims must be made through TAP.

Input tax adjustment for bad debt relief. Jabatan Kastam Diraja Malaysia. How Bad Debt Relief Works.

The amendment to the final GST-03 Return should be made would be allowable in the following situations subject to meeting conditions. Click on Create Bad Debt Relief 4. For the purposes of GST in Malaysia Bad Debt Relief refers to any amount owing on an invoice that has not been paid or has been partially paid after six calendar months from the date of issue.

Adjustment made to output tax eg. My understanding is that in the case of Output GST the declared amount of an invoice could be claimed after six months if the invoice is not paid by the customer the same applies vice versa for vendors. For example you make payment to vendors and you must also pay bank fees to banks.

Track Bad Debt Recovered- Once customer return a payment system could identify it as a bad-debt and then recover it. Dear Community Memebers I am struggling with the handling of GST for Bad Debt in Malaysia. A registered person is entitled to claim bad debt relief even though the bad debt is not written off from his books.

Then use the Bad Debt expense account again on the second line with an A GST code for the 700 GST relief. If you account for goods and. Output Tax has to be reported either upon Invoice or Collection whichever comes first.

Determine gst bad debt relief and recovered between. Check the document to claim bad debt relief. Obtain GST registration number from customer who already registered under GST Act.

Define the search criteria then click on Search 2. Output tax adjustment. 11 rows Amendments.

Note that it is six calendar months and not 6 months from date of invoice. For the journal entry to be generated define the Date then click OK. Recap of GST Treatment for Bad Debt Relief Value of the Bad Debt Relief If only part payment has been received by a registered person then the bad debt relief is only restricted to the balance payment that has not been received.

Per Malaysia GST regulations GST will be applied to the bank charge. B he has not received any payment in respect of the taxable supply from a debtor. According to the GST guides no GST adjustment is allowed to be made after 31 August 2020.

The registered person may claim the tax as bad debt relief by amending his final return in accordance to subsection 41b Repeal Act. Add the adjustment amount into Final GST Return amendment. The Bad Debt Relief function is located at Accounting Journal Entry GST Bad Debt Journal AR Bad Debt Relief Bad Debt Relief Listing screen.

That is whatever amount entered into the Net amount field will be transferred to the GST amount field. GST on purchases directly attributable to taxable supplies. Go Back to EasyAccSoft.

For the purposes of gst in malaysia bad debt relief refers to any amount owing on an invoice that has not been paid or has been partially paid after six. MoneyWorks has preset the A GST code as All tax. GL Code GL Description Local DR Local CR Add to Final GST.

You can apply for bad debt relief from the Comptroller of GST for return of the output tax previously accounted for and paid by you. Bad debt relief claim. 1 subject to regulations made under this Act any person who is or has ceased to be a taxable person may make a claim to the Director General for a relief for bad debt on the whole or any part of the tax paid by him in respect of the taxable supply if.

Total Input Tax Inclusive of Bad Debt Relief other Adjustments 62. Thus a business will need to report and pay the Output Tax once an Invoice is issued rega. Item 1Issuance of invoice before effective date for supply made on or after effective date.

On the other hand if you as a customer have not paid your supplier within 12 months from the due date of payment you are required to repay to the Comptroller the input tax that you have previously claimed if any. After 01 June 2018 my debtor repays the amount which I have been given relief. Item 3Claiming bad debt relief.

Pin By Sharon Roseberry On Lord Of The Rings The Hobbit Really Funny Pictures Really Funny Tumblr Funny

Gst Sales Purchase Deferred Tax Journal Adjustment Estream Software

Illustration Diagram For Output Tax Business Solution Facebook

Globla Indirect Tax Services Kpmg Global

Bad Debt Relief Recovery Myobaccounting Com My

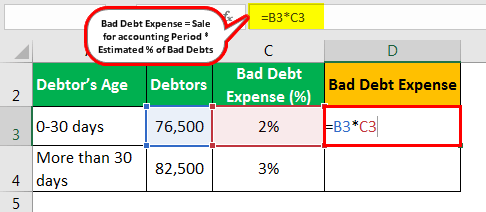

Bad Debt Expense Formula How To Calculate Examples

Gst 15 Bad Debt What Is 6 Months Bad Debt Relief Pdf Free Download

Gst 15 Bad Debt What Is 6 Months Bad Debt Relief Pdf Free Download

Newsletter 22 2019 Gst Guide On Transition Issue Page 002 Jpg

Gst 15 Bad Debt What Is 6 Months Bad Debt Relief Pdf Free Download

Gst Sales Purchase Deferred Tax Journal Adjustment Estream Software

Bad Debt Expense Formula How To Calculate Examples

Gst 15 Bad Debt What Is 6 Months Bad Debt Relief Pdf Free Download